Finbourne Technology is a developer of advanced financial software for the asset management industry. We create data systems to enhance the availability and utility of information, to simplify user access and reduce operating and capital costs.

We thank the judges for selecting us to the shortlist and giving us this opportunity to present ourselves. FINBOURNE’s LUSID platform tackles a huge market need. Investment management is heading for global assets under management (AUM) of $145 trillion by 2025. In the UK alone there are 10 million pensioners and our technology’s aim is to help them all. We estimate that global buy-side spend on technology is $50bn annually and growing. In the face of all this asset growth, asset managers are facing headwinds. Increasing demand for more transparency, better reporting, and increasing regulation has inflated the cost base. At the same time, the active vs passive debate and low absolute level of yields have combined to put pressure on their fees.

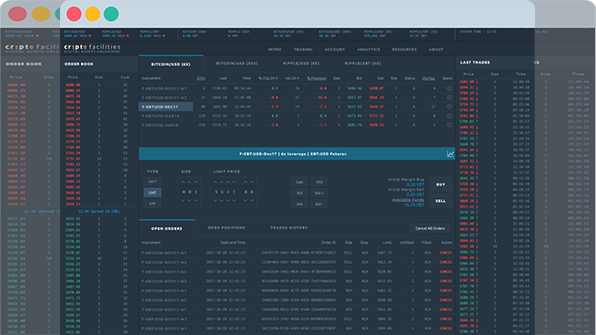

In October FINBOURNE launched LUSID® “a revolutionary replacement software system for the asset management industry. LUSID, which stands for ‘Liberated Unified Secure Data-machine’ is a new cloud-based system which will replace existing in-house hardware and software… dramatically cut operational and capital costs, modernise capabilities and liberate managers from infrastructure worries to concentrate on their core competency – asset management.”

We try to summarise that in our strapline: LIBERATE/SIMPLIFY/CONNECT. FINBOURNE may be a start-up but we’re not in any way typical. Unlike a lot of start-ups, we focus on the end customer – the asset manager – we are not payments or selling a modular service to a market intermediary. Although we would all love to be 25 again, understanding the industry problem necessitates many years of dedication. Our average age is 38 and we have had heavy duty experience in both financial technology and financial management. As such, we are building a platform which experience tells us is both needed and will function as designed. Because of our previous experience, we knew we had to collaborate with industry thought leaders so we set up the LUSID Design Council to fashion a platform that will give our customers what they want. The Council includes, among others, two top ten global and European asset managers and a major international bank, in its custodian guise.

Working with our clients we know the marketplace cares more about such things as immutability and bi-temporal versioning and far less about “distributed nodes” and “cryptography”.

The technology choices we made were based on practical need.

The thought leadership, and the deep tech skills lie in combining only the essential and appropriate elements of technology in a cloud-based platform to meet the needs of complex portfolios. This is unique. And important because, in so doing, LUSID will cut costs – running and capital – using computational need rather than the much-hated percentage of AUM pricing mechanism. Specific benefits of LUSID include:

■ Real-time, every time: valuations, transactions, analyses

■ LUSID never forgets: every transaction or data change immutably recorded, kept in a bitemporal store so that effects and circumstances of any change are instantly available

■ Open APIs: LUSID adopts an open Application Programming Interface to facilitate best-of-breed vendor integration. It is not a compulsory one-stop shop.

■ Compliance enabled: the ‘never forget’ feature maintains data which makes future compliance need easy to access and makes specialised RegTech software for keeping archives of data redundant.

■ State of the art security: we use best financial industry practice, built on top of AWS’ world-class physical security.

LUSID is a market utility. Just as no business would think of installing its own water supply, nor should fund managers endure the expense of installing, updating, staffing and worrying about systems for recording and accessing investment data. These are non-differentiating activities and their costs will be mutualised by LUSID. This liberates:

■ By granting freedom of charges from technology updates

■ From the common problem of conflict between inherited systems

■ Because LUSID is unified, asset managers, asset owners, institutional investors have a single source of truth, a definitive record, for the of fiduciary duties

■ Through scalability: for large or small firms, across asset types, system capacity is no longer a worry

■ Through simplified budgeting: reduced costs and improved transparency on costs

■ By eliminating the distraction of running infrastructure: giving asset managers more time and money to research investment decisions – liberating core competency.

FINBOURNE believes that to change the world, you work with it: less “disruption” more collaboration. In December, at a large tech industry convention in New York, the audience voted us ‘the start-up I would most like to partner with’. Who wants pension savings “disrupted”? We don’t, but we do want to partner with people wanting to improve the customer experience.

Finding the right people will be key to our growth: last year, we doubled in size and some of the team declined job offers from investment banks and impressive companies like DeepMind. Unlike others, we haven’t off-shored key technology roles as proximity to on-shore clients improves the quality and interest of the work we offer. Yes, we need to show a way to financial reward but we are doing this, at least in part, because it is stimulating and, simply, important.

Looking forward to 2018; we dare to hope that a happy confluence of ever-increasing cloud adoption, a post-MIFID II era, and maybe greater clarity on BREXIT implications may lead to fewer distractions for your pension fund manager. Who can now concentrate on improving their performance and maybe even upgrading their systems. Within our advisory group we have noticed a growing appreciation of the worth of collaboration and co-operation in cutting admin costs. We expect to see this realisation grow elsewhere in the finance industry.

Freedom (for asset managers) to improve performance has been an important part of our positioning and we expect it to be even more relevant in 2018.