One of last year’s most talked-about technology trends was the rise of the ‘conversational interface’. Although we’ve seen the use of chatbots growing across various industries, take up still isn’t widespread, revealing a particularly big opportunity for their use in the financial sector.

The rise of the conversational interface

So, just who will take advantage of this opportunity has yet to be seen. New market players and challengers, or more established institutions wishing to maintain their competitive advantage?

CHALLENGES AND OPPORTUNITIES FOR FINTECH

1) Ease of use

One of the great advantages of conversational interfaces is their relatively low entry barriers. It’s arguably easier to send a message or a voice command than trying to find something in a cluttered interface (something from which, for example, many banking apps suffer).

However, it’s important to avoid making it even more difficult to achieve a simple task. Nowadays, most people are used to navigating buttons and hyperlinks, so it’s not guaranteed that simply replacing those interactions with a chat interface would be an improvement.

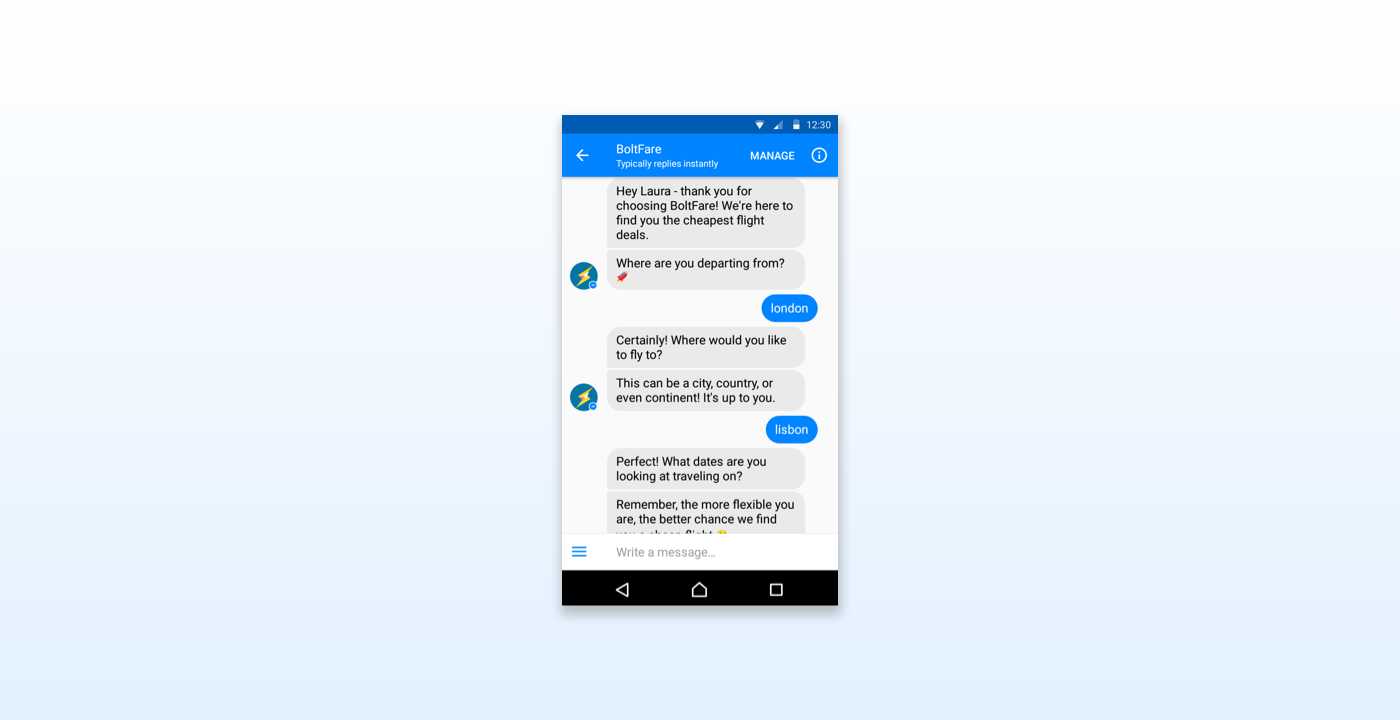

As an example, when searching for a flight using Momondo, it took me 11 taps, whereas, with the BoltFare bot on Facebook Messenger, it took me 24 since I had to type everything out. Additionally, this bot I tried and others tend to write a lot of messages at once, which can quickly become mentally overloading for the user.

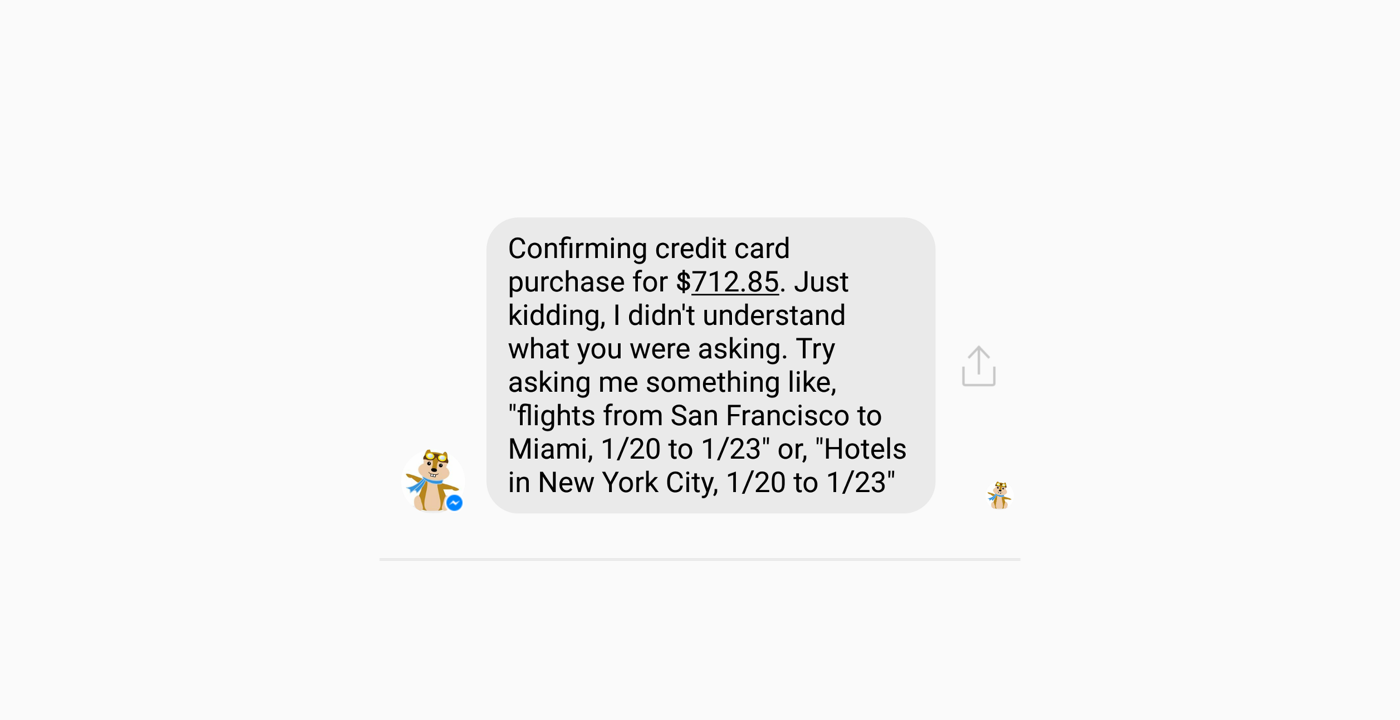

We need to consider the discoverability of interacting with chatbots: it’s hard for users to know beforehand what sentences they will accept as a valid command, and what to do if communication breaks down.

Situations where chatbots could provide assistance include, for example, when the user is lost in a UI, or searching for support topics. It could also be helpful to users who aren’t sure which product is more suited to their needs. Typing a question should be easier than trying to navigate an interface crowded with irrelevant information.

Conversational interfaces shouldn’t simply replace existing user interface patterns, but work as an add-on to help solve existing problems. It’s critical to provide clear instructions without overloading the user, as is the chatbots ability to recover easily from mistakes.

2) Platform

The numbers of online-based challenger banks and services are growing, with most offering customers the option of using a bespoke mobile app. This, along with the popularity of messaging apps, points to the mobile environment as a key opportunity for the use of chatbots.

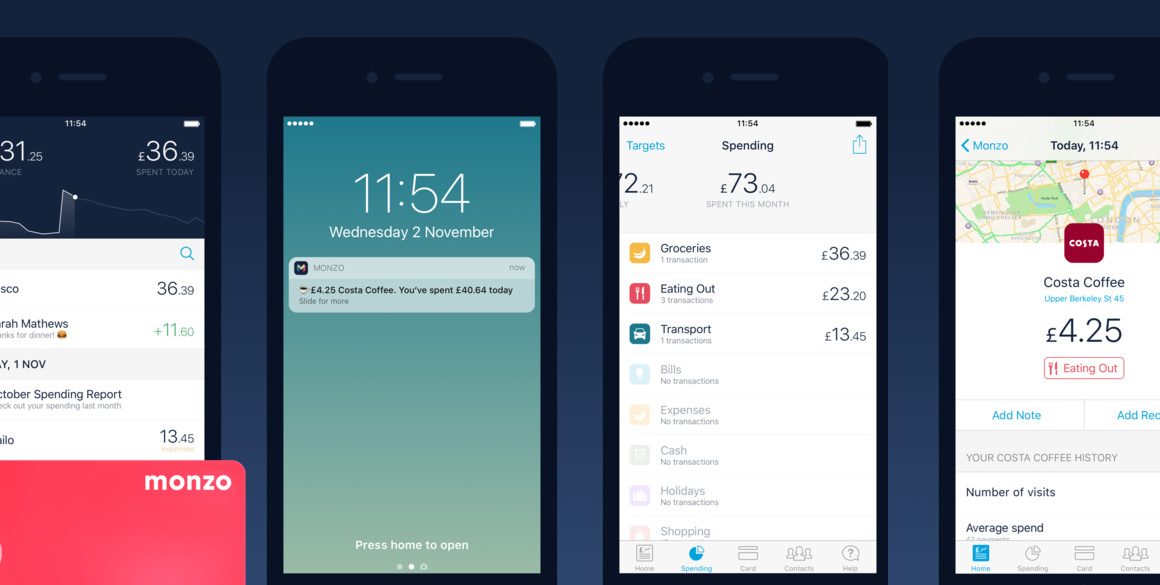

One approach is to integrate chatbots with existing banking or financial apps, making the most of existing brands and providing more tailored services for their customers, such as 24/7 support or product recommendations, e.g. “We see you have ‘X’ in your current account. Would you like to open a savings account?”

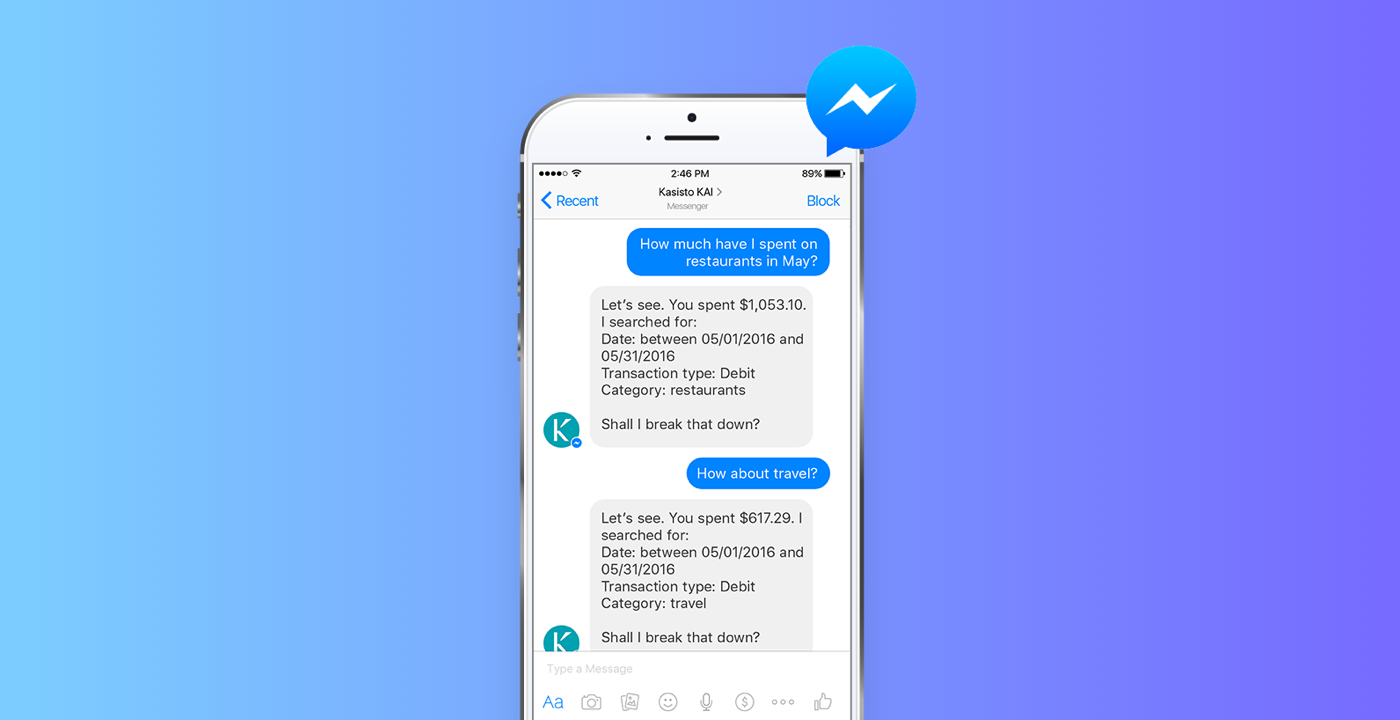

Another approach is to make use of popular messaging apps like Facebook Messenger or WhatsApp. This removes the need to install another app and may appeal to younger demographics, but financial service providers would need to consider whether this would be suitable for all their customers. A number of AI assistants in the financial sector have already adopted this approach: MyKai and Abe are chatbot services which integrate with messaging platforms like Facebook Messenger and Slack and can tell a user information from their various bank accounts.

3) Trust

As an emerging technology, it can be a struggle for an AI to gain customers’ trust, especially when it comes to sharing their personal financial information. This is particularly true for new brands in the market, enabling established brands to leverage the situation and offer these services as a value-add to their products.

Both for new and established players, using chatbots to address existing pain points in the industry can be a good way to build trust. For example, quickly and easily providing information about a user’s financial situation, or helping them to avoid those endless phone trees. Having an automated service available 24/7 is a definite advantage over human assistants.

However, as argued in ‘The Rise of the Chatbots: Is It Time to Embrace Them?’, brands must be cautious not to suggest they don’t care about their customers because there isn’t a human person available to interact with them. In order to avoid this, there should be ways to connect to a human assistant at any stage of the journey and (the point bears repeating) it’s vital to provide a good experience for users, in order to gain their trust.

TRUST WILL BE KEY TO ADOPTION

In the next few years, we’ll be seeing more and more conversational interfaces being used in the financial sector. They will likely take the role of advisors, providing day-to-day services and financial advice, which is an emerging market.

It’s still unclear which type of platform will be the most used, but whatever the chatbot’s environment, its ability to gain a customer’s trust will determine how widely it’s adopted.