Why do you feel that your company has been nominated by the panel?

FundApps has extraordinary product/market fit, an incredible client roster and offers services to automate some of the most complex tasks in financial compliance. These services are used by some of the largest asset managers, hedge funds and pension funds globally. With over 500 compliance professionals using our services daily we have built a reputation for our expertise, regulatory knowledge, and support. Our Net Promoter Score is in the 99th percentile for B2B tech companies.

Based in the heart of East London, FundApps stands apart from the crowded FinTech scene and shines brightly in the burgeoning RegTech scene. With 32 employees from over 22 nationalities, our skills range from infrastructure and computer architecture to financial compliance and marketing. We’re an entirely bootstrapped company that has never taken a penny in angel investment or venture capital. We have been profitable since signing our first client, organically expanding as we closed new deals and developed new services. We currently monitor over 3 Trillion USD of assets every day, servicing 2 of the world’s 10 largest hedge funds and 2 of North America’s 10 largest pension funds.

Financial compliance is a demanding and exacting task. Investment positions held by a company can change multiple times a day, and keeping track of constantly changing financial legislation is a big resource commitment for compliance teams. Traditional software is bereft of features, difficult to maintain, lacking in legal content and often extremely complicated to use. FundApps is unique as we don’t just provide software: we deliver truly managed services, blending regulatory insight with technology. Rather than make all of our clients encode identical financial regulation themselves, we relieve them of that burden and do it for all of them, all at once, whenever legislation is updated.

Why was the company set up? How did you select the vertical and decide to be a part of the global FinTech community?

FundApps was founded in 2010 by Andrew P. White, after the frank realisation that compliance could be done far more effectively. What started as an idea first coded in a South London bedroom soon evolved to be a multi-million-pound software company headquartered in East London, with a growing office in Manhattan; making compliance simple for financial institutions around the world by blending innovative technology with regulatory expertise in a clever, easy-to-use package.

What is your company looking to achieve in 2018?

We continually focus on expanding our client base, increasing awareness of regulatory requirements and how our services can help make compliance simple.

What challenges did you face in your initial years? What can your peers learn from it?

A key challenge we faced as a startup was building brand awareness. It’s very hard to sell a service when no-one has heard of you. In the first few years, there were issues around being cloud-based. People weren’t aware of what it really meant and they needed to be convinced that cloud was secure. Today it has flipped completely and people are actively looking for cloud-based solutions.

One massive take-away is to remain tenacious! Things take time and 90% of products and services are not overnight successes. Have patience and try to continually learn and improve.

If you have to list five factors that have been/are the biggest asset to your organisation, what would they be and why?

1. People and partnerships

FundApps was founded, built and is continuously improved by people with extensive compliance experience. By building strong relationships with industry experts such as regulators and lawyers, FundApps combines its software with up-to-date regulatory analysis to make compliance simple for the financial industry.

2. Dedicated team of compliance experts

Regulatory expertise is at the core of what makes FundApps different. Our dedicated team of compliance experts monitors and interpret the latest in financial regulation, coding it into rules so our clients don’t have to. The decades of compliance experience held by the team at FundApps set us apart from other providers, who are typically just software companies operating in the regulation space.

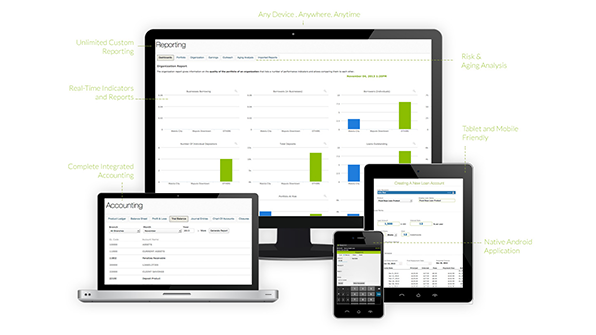

3. Intuitive, easy-to-use software

Maintaining compliance is a difficult task, and there is no room for software to make things even more complicated. FundApps’ web-based compliance platform provides everything needed to identify and respond to regulatory requirements quickly and easily. All users need is a modern web-browser. And due to the subscription model, a single yearly fee is charged with zero hidden costs.

4. Instant updates

Updates to our compliance platform and the rules are delivered seamlessly to users. We have always been cloud-based, so updates take place instantly in the background. This is a breath of fresh air for our clients, who are typically used to using branched software that would require an armada of consultants and a week of downtime every six months so updates could be deployed.

5. Community

FundApps’ compliance forum is used by our client community to ask questions and share knowledge about the intricacies of regulation. Much of its functionality is about harnessing the power of our user community, e.g. letting users comment on rules and making these comments visible to each user. Similarly, by using the power of crowd-sourced data, there is no longer a need for every client to input the same data.

With so much competition in the FinTech space, and so many companies failing to get traction, what has allowed your business to thrive?

The typical mistake of most start-ups is to build a product and look for a market to sell it to. Hence why “achieving product/market fit” is so difficult for many companies. With FundApps it was simple – compliance is something every single financial institution has to do, therefore we knew the market was there. All we had to do was provide a service that was so compelling that it beat the competitors hands-down.

How do you bring the best out of your team?

As Lee Iacocca said, “I hire people brighter than me and then I get out of their way.”

With so many buzzwords in FinTech around disruption and innovation, how have you really stepped up to solve an industry problem?

Financial compliance is a demanding and exacting task. Our clients typically invest tens or hundreds of billions of dollars into equities traded in dozens of jurisdictions, and the complexities in maintaining compliance in so many countries are enormous. Previously, the fund industry has had two choices to deal with a shifting sea of regulation: buy a large, expensive and archaic software package… or build a large, expensive and unreliable software package in-house.

FundApps offers a third choice with its unique compliance service and provides both technology and content. Our services have been designed based on the input provided by the real compliance experts – the FundApps user community. Combining software and up-to-date regulatory content, provided by aosphere (an affiliate of Allen & Overy), our services address the key challenges of investment restrictions, position limits and shareholding disclosure monitoring, enabling clients to build and sustain a robust compliance infrastructure and a culture of oversight and transparency. It also significantly addresses the risks of non-compliance, which attracts ever stricter penalties.

One of the biggest problems that compliance teams at large financial institutions face is keeping track of regulatory updates around the world.

By supporting over 90 jurisdictions with our compliance services, we’re extremely attractive to clients with an international approach to investment, as well as those with offices in multiple countries. The global fund industry currently manages about $74 trillion, so the target market is enormous. In 2013 KPMG estimated that the investment management industry spends 7% of its total costs on “compliance-related technology, staff, and strategy”, and that number has certainly grown in the past four years. This shows that firms do not only spend a significant amount of money on compliance technology, there is also enormous appetite for services that increase efficiency, save time and lower costs, such as FundApps.

What do you see as the major trends for the year ahead?

Distributed Ledger Technology will still be over-hyped but might actually start to deliver on some of its promises.